Muskoka Market Conditions March 2023

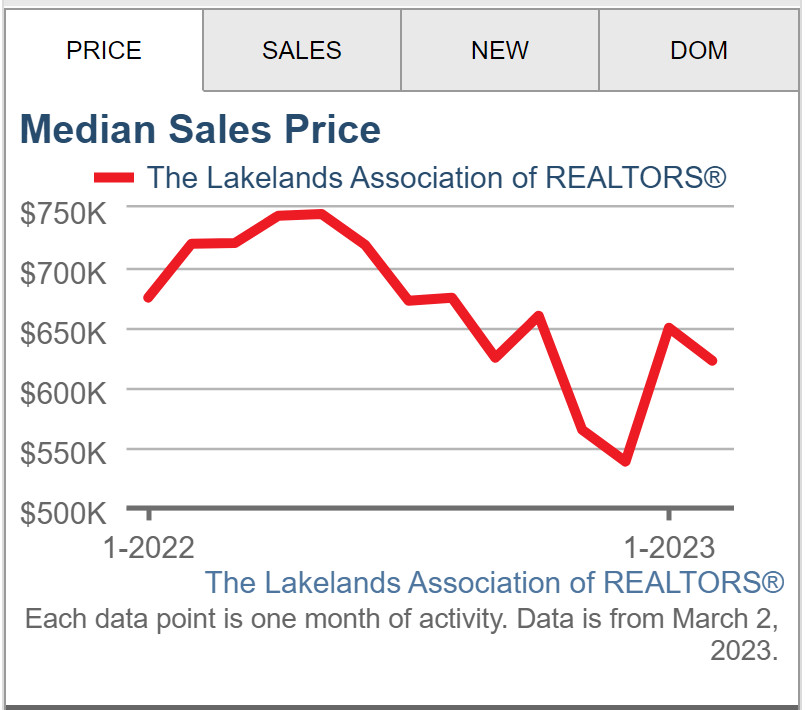

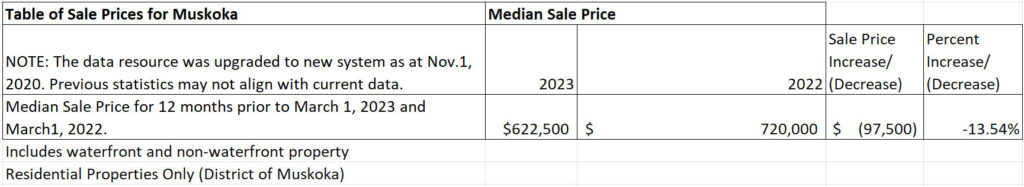

Muskoka Market Conditions: The median residential sale price in the District of Muskoka decreased by approximately 13.54 % during the 12 months previous to March 2023 compared to the 12 months previous to March 2022. Sales of vacant land and/or commercial property were not included in the data source.

Area included in source data: District of Muskoka, residential waterfront and residential non-waterfront improved sales only. (Source: Lakelands Association of Realtors MLS data)

Disclaimer: The information and data in this newsletter is provided for personal use only and was obtained from sources considered reliable and was not verified. It is up to the reader of this information is to determine the suitability and use of the information. Any and all liability to the reader is expressly denied.

The median sale price for waterfront and non-waterfront property has recently been decreasing and was $622,500 at March 1, 2023. (12 month rolling aggregate median price)

HOUSING SUPPLY – Canadian Real Estate Association (CREA)

January 2023

The Canada housing market began the year in a state of rebalance, with many buyers and sellers remaining cautious while they wait to see where the market is headed. National home sales edged up 1.3% month-over month

as of last measure, while new listings fell 6.4%, equaling 4.2 months of inventory heading into January, according to the Canada Real Estate Association (CREA). Demand for housing persists, but inflation, higher borrowing costs, and elevated sales prices have cut into affordability, causing market activity to decline compared to this time last year.

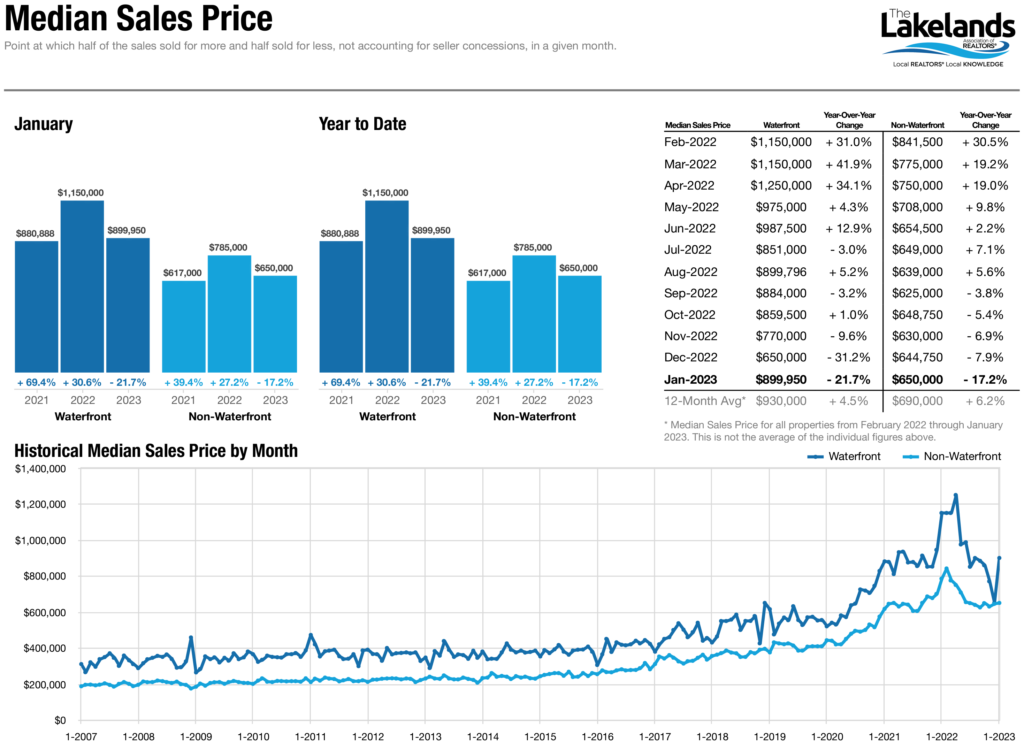

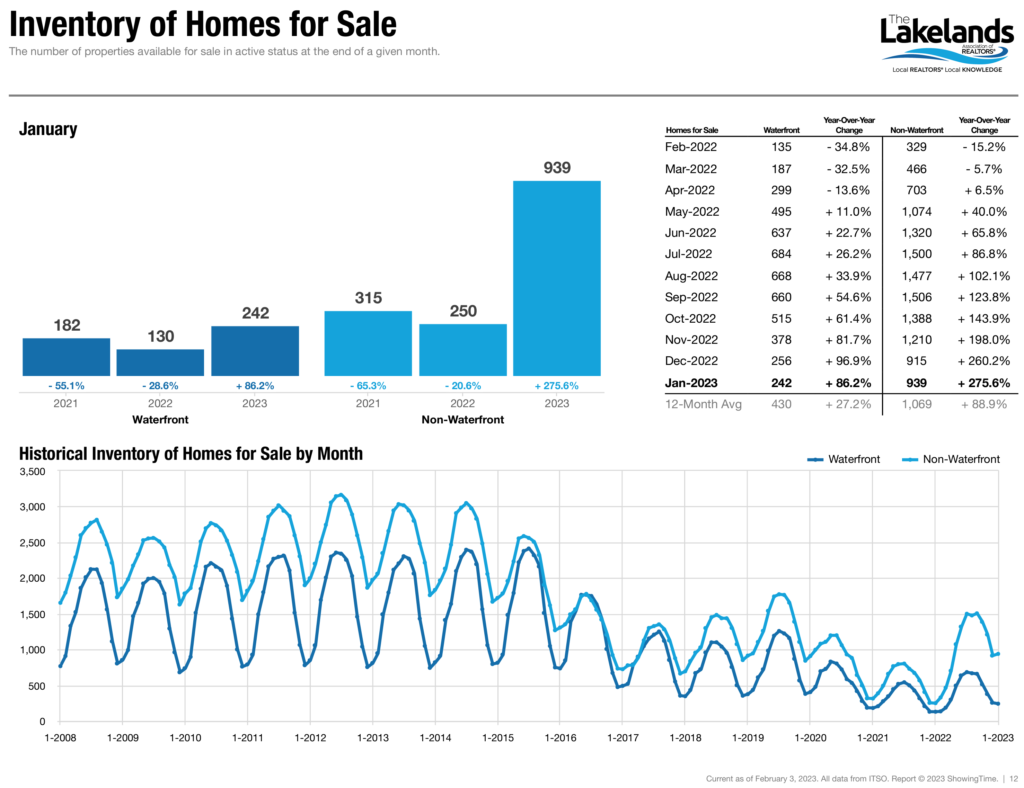

New Listings decreased 8.4 percent for Waterfront homes but increased 53.9 percent for Non-Waterfront homes. Sales decreased 34.6 percent for Waterfront homes and 33.7 percent for Non-Waterfront homes. Inventory

increased 86.2 percent for Waterfront homes and 275.6 percent for Non-Waterfront homes.

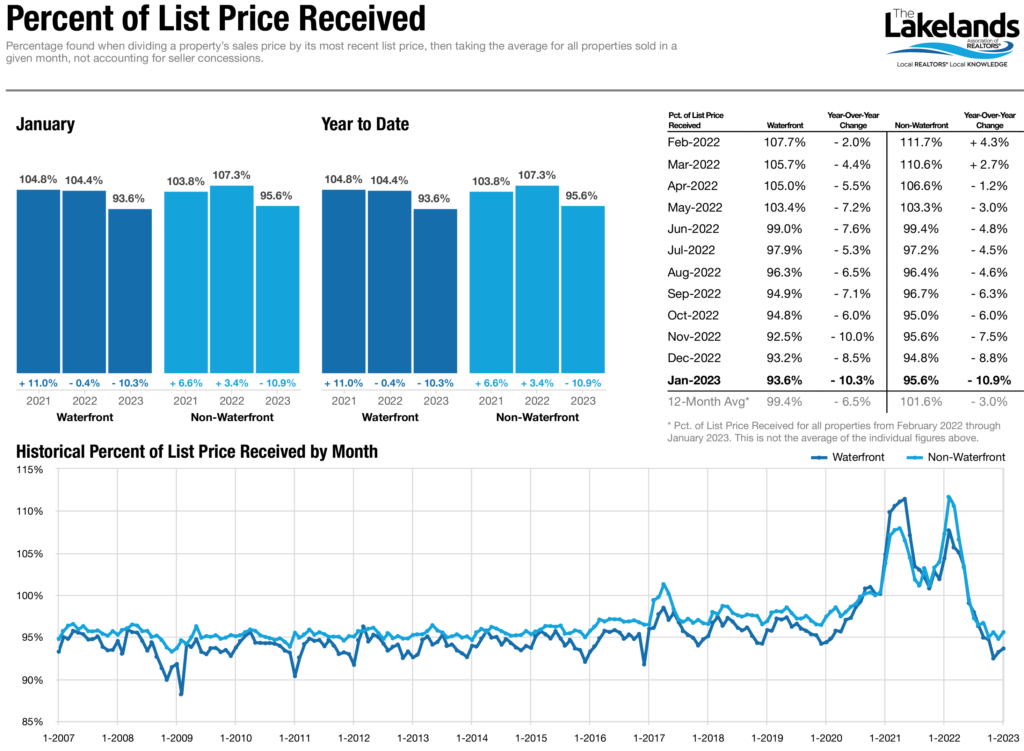

Median Sales Price decreased 21.7 percent to $899,950 for Waterfront homes and 17.2 percent to $650,000 for Non-Waterfront homes. Days on Market increased 78.0 percent for Waterfront homes and 92.0 percent for Non-Waterfront homes. Months Supply of Inventory increased 228.6 percent for Waterfront homes and 460.0 percent for Non-Waterfront homes.

The decline in home sales continues to put downward pressure on sales prices, with the Aggregate Composite MLS Home Price Index (HPI) falling 1.6% month-over-month nationwide, marking the 9th consecutive monthly price drop, according to CREA. Although prices have fallen more than 13% from their peak in February 2022, the cost of housing remains significantly higher than it was in 2019, prior to the start of the pandemic. Borrowing costs continue to rise as the Bank of Canada attempts to tame inflation, with the key interest rate now 4.50% following the Bank’s latest quarter point.

For more information about the Muskoka market contact A1 Accurate Appraisal, 3-200 Manitoba St., Suite 329, Bracebridge, ON, Canada, P1L 2E2

Phone: (705) 641-1789 Email: